Top Qs

Timeline

Chat

Perspective

U.S. Dollar Index

Economic measure of US dollar exchange rates From Wikipedia, the free encyclopedia

Remove ads

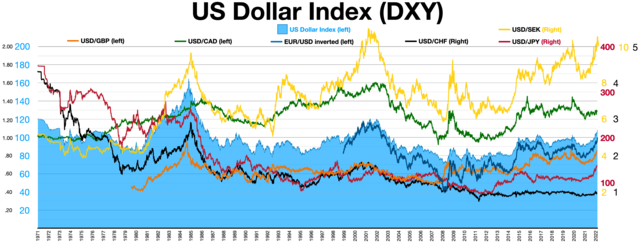

The U.S. Dollar Index (USDX, DXY, DX, or, informally, the "Dixie") is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies,[1] often referred to as a basket of U.S. trade partners' currencies.[2] The Index goes up when the U.S. dollar gains "strength" (value) when compared to other currencies.[3]

US Dollar Index (DXY)

The index is designed, maintained, and published by ICE (Intercontinental Exchange, Inc.), with the name "U.S. Dollar Index" as a registered trademark.[4][5]

It is a weighted geometric mean of the dollar's value relative to following select currencies:

- Euro (EUR), 57.6% weight

- Japanese yen (JPY), 13.6% weight

- Pound sterling (GBP), 11.9% weight

- Canadian dollar (CAD), 9.1% weight

- Swedish krona (SEK), 4.2% weight

- Swiss franc (CHF), 3.6% weight

Remove ads

History

Summarize

Perspective

USDX started in March 1973, soon after the dismantling of the Bretton Woods system. At its start, the value of the U.S. Dollar Index was 100.000. It has since traded as high as 164.720 in February 1985, and as low as 70.698 on March 16, 2008.

The makeup of the "basket" has been altered only once, when several European currencies were subsumed by the euro at the start of 1999. Some commentators have said that the makeup of the "basket" is overdue for revision as China, Mexico, South Korea and Brazil are major trading partners presently which are not part of the index whereas Sweden and Switzerland continue as part of the index in spite of their trade volume with the US being much less relevant than in the early 1970s.[citation needed]

Remove ads

Relation to Economic Growth in Developing Countries

Summarize

Perspective

Some scholars posit that the cyclical fluctuations in the Dollar Index, commonly referred to as the Dollar Cycle, are intricately linked to economic growth trends in developing nations.[8][9] According to this hypothesis, a period of appreciation in the dollar, known as a dollar upcycle, tends to correlate with a decline in economic growth in emerging markets. Conversely, a period of depreciation, or a dollar downcycle, is associated with an increase in growth within these economies. The value of the U.S. dollar also correlates with global interest rates, particularly affecting borrowing costs for developing nations. When the USD depreciates, borrowing becomes cheaper and foreign investment increases. Conversely, USD appreciation raises interest rates, making borrowing more expensive and reducing the flow of foreign direct investment to these countries.[10] Because most commodities are traded in U.S. dollars globally, a drop in the dollar's value often results in higher commodity prices in the local currencies of developing countries. This increase in prices can enhance local income and consumption, leading to economic growth. On the other hand, when the USD strengthens, commodity prices generally decline, which can hinder growth in these regions. Consequently, the economic development cycle in developing nations is closely linked to the cycle of commodity prices, which is driven by fluctuations in the USD.[11][12]

Remove ads

Trade-weighted USD Index

Trade-weighted US dollar index

The trade-weighted US dollar index is a currency index created by the Federal Reserve to measure the exchange rate of the United States dollar compared to the nations that it trades with the most, the more trade a country has with the United States the more that exchange rate weighs on the index. The index was created in 1998 during the creation of the Euro.[13]

Quotes

ICE provides live feeds for Dow Futures that appear on Bloomberg.com and CNN Money. USDX is updated whenever U.S. Dollar markets are open, which is from Sunday evening New York City local time (early Monday morning Asia time) for 24 hours a day to late Friday afternoon New York City local time.

Calculation

The U.S. Dollar Index is calculated with this formula:[14] USDX = 50.14348112 × EURUSD−0.576 × USDJPY0.136 × GBPUSD−0.119 × USDCAD0.091 × USDSEK0.042 × USDCHF0.036

Trading

US Dollar Index futures are traded for 21 hours a day on the ICE platform with futures having a March/June/September/December quarterly expiration cycle. The futures are physically settled and can be redeemed for the underlying currencies the third Wednesday after expiration.[15] It is also available indirectly in exchange-traded funds (ETFs), options, contracts for difference and mutual funds.

See also

References

External links

Wikiwand - on

Seamless Wikipedia browsing. On steroids.

Remove ads