Carbon price

CO2 Emission Market / From Wikipedia, the free encyclopedia

Dear Wikiwand AI, let's keep it short by simply answering these key questions:

Can you list the top facts and stats about Carbon price?

Summarize this article for a 10 year old

Carbon pricing (or CO2 pricing) is a method for governments to mitigate climate change, in which a monetary cost is applied to greenhouse gas emissions in order to encourage polluters to reduce fossil fuel combustion, the main driver of climate change. A carbon price usually takes the form of a carbon tax, or an emissions trading scheme (ETS) that requires firms to purchase allowances to emit.[1] The method is widely agreed to be an efficient policy for reducing greenhouse gas emissions. Carbon pricing seeks to address the economic problem that emissions of CO2 and other greenhouse gases are a negative externality – a detrimental product that is not charged for by any market.

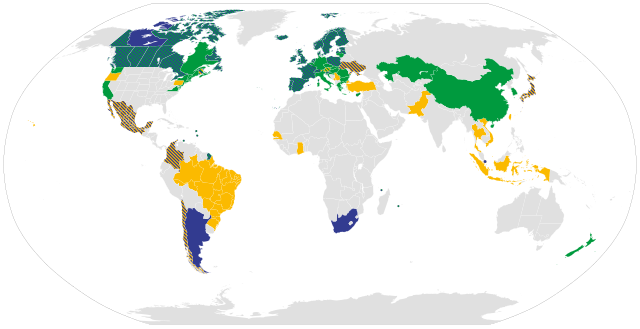

21.7% of global GHG emissions are covered by carbon pricing in 2021, a major increase due to the introduction of the Chinese national carbon trading scheme.[2][3] Regions with carbon pricing include most European countries and Canada. On the other hand, top emitters like India, Russia, the Gulf states and many US states have not introduced carbon pricing.[4] Australia had a carbon pricing scheme from 2012 to 2014. In 2020, carbon pricing generated $53B in revenue.[5]

According to the Intergovernmental Panel on Climate Change, a price level of $135–$5500 in 2030 and $245–$13,000 per metric ton CO2 in 2050 would be needed to drive carbon emissions to stay below the 1.5°C limit.[6] Latest models of the social cost of carbon calculate a damage of more than $300 per ton of CO2 as a result of economy feedbacks and falling global GDP growth rates, while policy recommendations range from about $50 to $200.[7][failed verification] Many carbon pricing schemes including the ETS in China remain below $10 per ton of CO2.[3] One exception is the European Union Emissions Trading System (EU-ETS) which exceeded €100 ($108) per ton of CO2 in February 2023.[8]

A carbon tax is generally favoured on economic grounds for its simplicity and stability, while cap-and-trade theoretically offers the possibility to limit allowances to the remaining carbon budget. Current implementations are only designed to meet certain reduction targets.