Top Qs

Timeline

Chat

Perspective

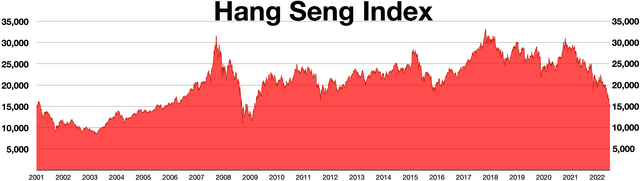

Hang Seng Index

Stock market index in Hong Kong From Wikipedia, the free encyclopedia

Remove ads

The Hang Seng Index (HSI) is a market-capitalisation-weighted stock market index in Hong Kong adjusted for free float. It tracks and records daily changes in the largest stock listings on the Hong Kong Stock Exchange and serves as the primary indicator of overall market performance in Hong Kong. These 82 constituent companies represent about 58% of the capitalisation of the Hong Kong Stock Exchange.[2]

HSI was publicized on November 24, 1969, and is currently compiled and maintained by Hang Seng Indexes Company Limited, which is a wholly owned subsidiary of Hang Seng Bank, one of the largest banks registered and listed in Hong Kong in terms of market capitalisation.[3] It is responsible for compiling, publishing and managing the Hang Seng Index and a range of other stock indexes, such as Hang Seng China Enterprises Index, Hang Seng China AH Index Series, Hang Seng China H-Financials Index, Hang Seng Composite Index Series, Hang Seng China A Industry Top Index, Hang Seng Corporate Sustainability Index Series and Hang Seng Total Return Index Series. Hang Seng in turn, despite being a public company, is controlled by another listed international financial institution HSBC Holdings plc. Both HSBC Holdings and Hang Seng are constituents of the index.

Remove ads

History

Ho Sin Hang, founding chairman of the Hang Seng Bank, conceived the idea of creating the Hang Seng Index as a "Dow Jones Index for Hong Kong".[4][5] Along with Hang Seng Director Lee Quo-wei, he commissioned Hang Seng's head of Research Stanley Kwan to create the index in 1964,[4] the index was initially used for internal reference in the Hang Seng Bank, they debuted the index on November 24, 1969.[5]

Remove ads

Investing in the Hang Seng Index

Mutual and exchange-traded funds

Index funds, including mutual funds and exchange-traded funds (ETFs), can replicate, before fees and expenses, the performance of the index by holding the same stocks as the index in the same proportions. ETFs that replicate the performance of the index are issued by Hang Seng Investment Management (Tracker Fund of Hong Kong, SEHK: 2800),[6] CSOP Asset Management (SEHK: 3037),[7] and iShares (SEHK: 3115).[8]

CSOP Asset Management offers an inverse ETF (SEHK: 7300)[9] that produces -1x daily return of the Hang Seng Index, as well as leveraged ETFs which attempt to produce 2x the daily return of either investing in (SEHK: 7200)[10] or shorting (SEHK: 7500)[11] the index.

Derivatives

In the derivatives market, the Hang Seng Index is traded as a futures contract on the Hong Kong Futures Exchange (HKFE). The full contract specifications are below:

| Hang Seng Index (HSI) | |

|---|---|

| Contract Size: | HK$50 Hang Seng Index Points |

| Exchange: | HKFE |

| Sector: | Index |

| Tick Size: | 1 |

| Tick Value: | 50 HKD |

| Big Point Value (BPV): | 50 |

| Denomination: | HKD |

| Decimal Place: | 0 |

Remove ads

Statistics

Summarize

Perspective

This section needs additional citations for verification. (August 2015) |

When the Hang Seng Index was first published, its base of 100 points was set equivalent to the stocks' total value as of the market close on July 31, 1964. Its all-time low is 58.61 points, reached retroactively on August 31, 1967, after the base value was established but before the publication of the index. The Hang Seng passed the 10,000 point milestone for the first time in its history on December 10, 1993, and, 13 years later, passed the 20,000 point milestone on December 28, 2006. In less than 10 months, it passed the 30,000 point milestone on October 18, 2007. Its all-time high, set on January 26, 2018, was 33,223.58 points[13] at closing. From October 30, 2007, through March 9, 2008, the index lost 9,426 points or approximately 30%. On September 5, it fell past the 20,000 mark the first time in almost a year to a low of 19,708.39, later closing at 19,933.28. On October 8, 2008, the index closed at 15,431.73, over 50% less than the all-time high and the lowest closing value in over two years. On October 27, 2008, the index further fell to 10,676.29 points, having fallen nearly two-thirds from its all-time peak, but passed the 20,000 point milestone again to 20,063.93 on 24 July 2009. The index reached 25,000.00 on August 19, 2014, reaching as high as 25,201.21 that day, later closing at 24,909.26 points. It continued rising to hit 26,000 on April 8, 2015, with a close of 26,236.86 The following day, it rose to as much as 27,922.67 before closing at 26,944.39. Yet again, another milestone was reached on April 13, 2015, rising to over 28,000 points, or closing to 28,016.34, the highest since December 2007. On July 8, 2015, the index fell as much as 2139 points. On 21 August the index entered a bear market. The index at that point hovered around 18000–19000 points,[14] until it ended in February 2016. On 24 June 2016, the market fell 1,000 points in response to UK EU referendum results that "Leave" won the vote against "Remain". Then, the markets continuously fell on 27 and 28 June 2016 before recovered slightly on 29 June 2016.

Annual returns

The following table shows the annual development of the Hang Seng Index, which was calculated from 1964.[15]

Remove ads

Components

Summarize

Perspective

On January 2, 1985, four sub-indices were established in order to make the index clearer and to classify constituent stocks into four distinct sectors. There are 82 HSI constituent stocks in total. As of February 2024 they are:[16]

Remove ads

See also

References

External links

Wikiwand - on

Seamless Wikipedia browsing. On steroids.

Remove ads